Wills, Trusts, Estates, Guardianship, Elder Law | 941-480-0333

Probate

What is probate?

“Probate” makes up a portion of society’s rules for the transfer of someone’s property upon their death. “Probate” is a formal court procedure where a deceased person’s assets are gathered by an authorized person, his or her debts are paid (or disputed), and his or her beneficiaries are paid according to his or her wishes. If the person dies without a will, his or her beneficiaries are determined by the scheme set up by the Florida Legislature. The costs of administration generally are paid first, then the legitimate debts of the deceased person (called the “decedent”), and then the beneficiaries. The process is court-supervised, which comes with advantages and its disadvantages. On the plus side, there’s greater accountability of the person appointed by the court to administer the assets (or “estate”), referred to as the “personal representative.” Additionally, the formal proceeding, if done properly, cuts off any creditor claims against the estate 90 days after notice. Probate can be slower and more expensive than other methods of asset transfer. Generally, however, a decedent’s beneficiaries have little choice in whether they need to do a probate—it depends primarily on the decedent’s estate plan. Because of the nature of the assets and/or the documents in place, a probate proceeding may be necessary to pass the assets to the beneficiaries.

Do all assets have to go through the probate process?

No. Many assets pass on after death without going through a probate proceeding. Some examples include:

- A home owned jointly with a right of survivorship;

- A bank account owned jointly;

- An investment account with named beneficiaries;

- An annuity with named beneficiaries;

- Proceeds from a life insurance policy with named beneficiaries;

- Retirement accounts (401(k)s, IRAs, Thrift Savings Plan) with named beneficiaries;

- Bank accounts with transfer on death or pay on death (called “TOD” or “POD”) beneficiaries;

- Property held by a trustee passing to the beneficiaries of the trust.

There are other ways that property passes without going through probate, but the list covers the most common. Essentially, property held individually without a named beneficiary must pass through probate. In order to determine whether a probate is necessary, we need to determine the nature of the assets.

What types of probate proceedings are there in Florida?

There are two types of probate in Florida: (1) Formal and (2) Summary. A summary probate generally is available only when the estate has $75,000 or less in assets (not including the homestead and any exempt property) or the decedent has been deceased for more than two years. If the scenario is right, a Summary Probate is sometimes less expensive and quicker than a Formal Probate, although both involve a court proceeding.

What is the probate procedure in Florida?

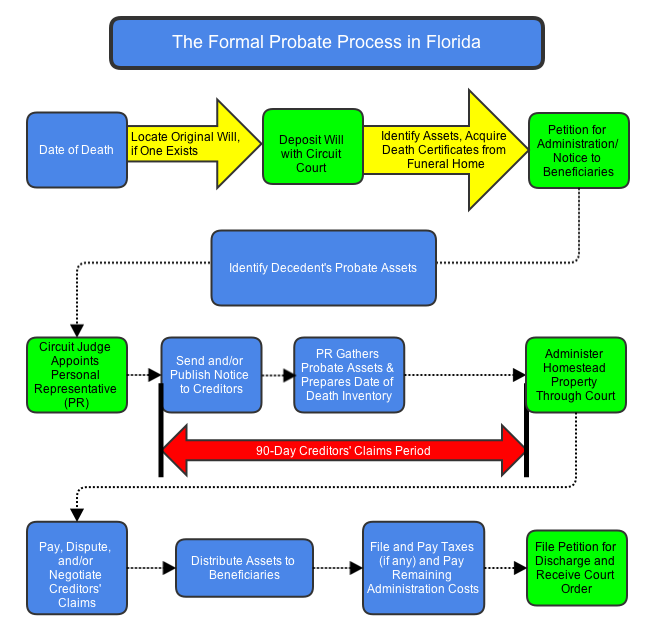

The Florida Bar has a consumer pamphlet to answer some general questions you have about probate, which can be accessed here. Below is a simplified graphical representation of the probate process. Keep in mind that this is a sample procedure and the facts of each case can change the procedure to some extent.

How long does it take?

At a minimum, the formal probate process requires the appointment of a personal representative, notice to creditors and a 90-day creditors’ claims period, distribution of the assets, a tax return, a homestead order (if there’s homestead property), and discharge of the personal representative. If everything goes smoothly, this will take 4-5 months. If there are complications, claims (particularly disputed ones), real property to sell, it could take longer. Our goal is to assist the personal representative to administer the estate as efficiently as possible and reduce the personal representative’s fiduciary liability.

How much does it cost?

Costs and fees to administer an estate involve court costs, publication costs, postage costs for notices, accountant’s fees, recording fees, fees for additional death certificates (if necessary), bond premiums (unless waived by the court), shipping costs for tangible personal property, personal representative’s fees and costs, realtor fees (if real property is sold), and attorney fees. Depending on the circumstances, there could be additional costs or fees, such as appraisal fees if there is valuable personal property or other property that requires an appraisal. Some of these costs can vary depending on the facts of the case, but others are fixed. Fixed costs include the filing fees, publication costs, and the costs for certified death certificates.

The current filing and recording fees for Sarasota County can be found here. The current filing and recording fees for Charlotte County can be found here. The current filing and recording fees for Manatee County can be found here.

Information on ordering death certificates in Florida can be found here.

Publication of the notice to creditors as required by law costs approximately $100.

Under Florida law, a personal representative is entitled to a reasonable fee paid out of the estate. The rules regarding the fee are set forth in section 733.617 of the Florida Code. It is not required that a personal representative take the fee according to the statute, but the fee schedule in the statute has been deemed “presumptively reasonable” by the legislature. The percentage is based off of the inventory value of the probate estate and any income earned during the administration. The fee for estates under one million dollars is 3%. For value over a million dollars, a gradually decreasing percentage is used to calculate the statutory fee.

Similarly, Florida law has a law regarding reasonable fees for the attorney for a personal representative. Just as with the personal representative, the statutory fee calculation is based off of the inventory value of the probate estate and any income earned during the administration. Section 733.6171 of the Florida Statutes says that a reasonable fee is $1,500 for an estate with an inventory value of less than $40,000; a fee of $2,250 for estates of between $40,000 and $70,000; $3,000 for an estate of between $70,000 and $100,000; $3,000 + 3% of any amount over $100,000 but less than one million dollars. Again, a gradually decreasing percentage is applied for any value of estate over one million dollars, ultimately down to 1% for any value over 10 million dollars.

Our experienced staff and can handle cases in any county in the State of Florida. We routinely deal with out-of-state personal representatives, usually family members of the decedent, and provide efficient, caring, and attentive service to our clients.